FDA imports that qualify under Section 321 of U.S. Customs and Border Protection (CBP) regulations allow low-value shipments to enter the country without paying duties or taxes. The threshold for this exemption is $800 per person per day, enabling faster clearance and reducing paperwork.However, recent rule changes mean all FDA-regulated products, regardless of shipment value, now require full FDA review before release, eliminating previous exemptions under Section 321. This shift impacts importers who relied on the streamlined process for low-value goods, especially those related to health and safety regulations.Understanding how Section 321 works alongside FDA requirements is critical for anyone dealing with FDA-regulated imports. Awareness of these updates helps avoid delays and ensures compliance with both CBP and FDA standards.

Understanding FDA Imports and Section 321 CBP

FDA-regulated imports are subject to specific customs and safety requirements in the United States. Section 321 of U.S. Customs law allows certain low-value shipments to enter duty- and tax-free under defined conditions. Knowing the precise rules and eligible products under this provision is critical for importers managing FDA-controlled goods.

Definition of FDA Imports

FDA imports include any products subject to regulation by the U.S. Food and Drug Administration. These typically cover foods, beverages, dietary supplements, pharmaceuticals, cosmetics, medical devices, and certain animal feed. All such imports must comply with FDA safety, labeling, and quality standards before entering the U.S.These imports require prior notice filings through the FDA’s Prior Notice System. This process informs the agency of shipments before arrival to facilitate risk assessment. Failure to meet FDA import requirements can result in delays, refusals, or penalties.

Explanation of Section 321 CBP

Section 321, under 19 U.S.C. § 1321, allows low-value shipments with a fair retail value of $800 or less per person, per day to enter the U.S. duty- and tax-free. This exemption bypasses formal customs entry procedures, simplifying imports and reducing costs for small shipments.CBP administers this exemption but recent changes have limited its availability, particularly for goods from certain countries or tariffed products. Technologies now enable better inspection of Section 321 shipments, increasing regulatory oversight.

Key Regulatory Requirements

Importers using Section 321 must ensure the shipment does not exceed the $800 value limit and that the products are eligible. Prior Notice to FDA remains mandatory for applicable food and feed products even under this exemption.All FDA data must be accurately submitted electronically before entry. Customs brokers and technology providers must be prepared to submit full data sets for low-value shipments. Any misrepresentation or non-compliance risks shipment delays or seizure.

Eligible Products for Section 321 Exemption

The exemption primarily applies to low-value consumer goods not subject to significant import restrictions. FDA-regulated products such as non-tariffed dietary supplements, cosmetic items, and certain low-risk foods may qualify.However, products subject to tariffs or restrictions related to trade remedies (e.g., Section 201, 232, 301 tariffs) or high-risk drugs and medical devices are excluded. Importers should carefully verify eligibility based on current CBP and FDA guidance.

Compliance and Procedures for FDA and CBP Imports

Compliance with FDA and CBP requirements involves specific documentation, the use of customs brokers, and a structured inspection and clearance process. Each of these elements must be carefully managed to ensure timely entry and avoid delays or refusals.

Documentation and Filing Procedures

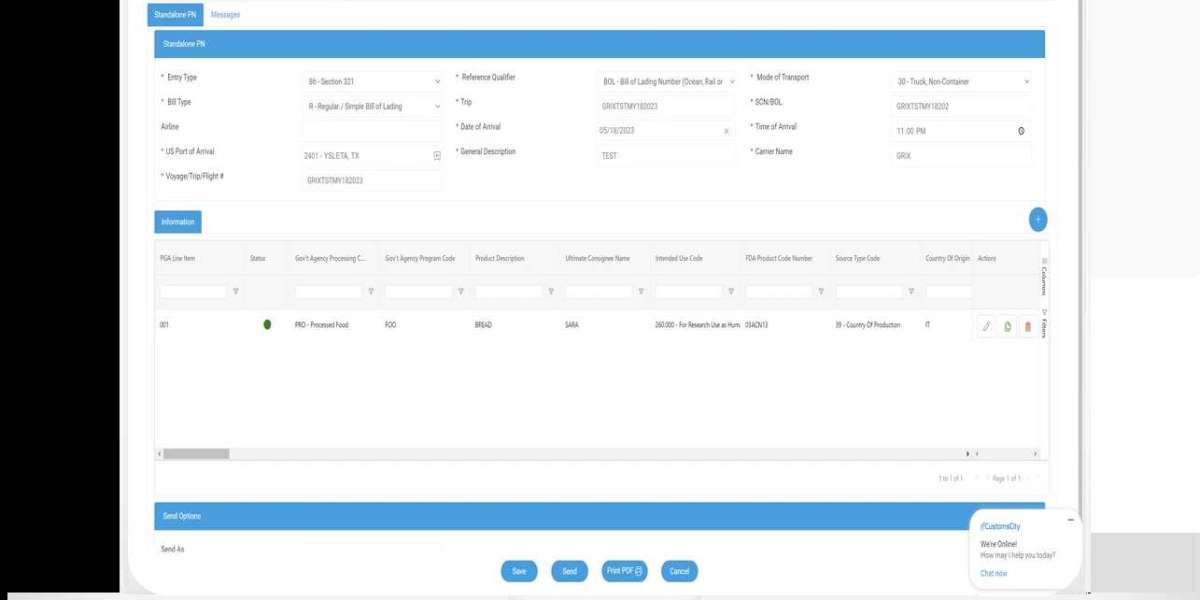

Importers must submit accurate and complete documentation to both FDA and CBP. This includes entry filings through the Automated Commercial Environment (ACE) system, which handles FDA-regulated product submissions.Key documents include prior notice for food imports, registration numbers for foreign establishments, and detailed product descriptions. Under Section 321, shipments valued at $800 or less can be imported duty-free but still require proper entry in ACE.All data must comply with FDA’s electronic review requirements. Missing or incorrect information can trigger delays or refusals. Importers should ensure alignment with both FDA’s and CBP’s filing guidelines to meet federal mandates.

Role of Customs Brokers

Customs brokers facilitate communication between importers, FDA, and CBP. They prepare, submit, and track entry documents while ensuring compliance with regulatory requirements.Brokers are responsible for verifying product classifications, valuations, and documentation before submission. They also advise importers on any changes in policies, such as recent rescissions of exemptions for low-value Section 321 shipments.Using licensed brokers helps avoid errors that could result in inspections or seizures. Importers depend on brokers’ expertise to reduce risks and expedite clearance, especially for complex FDA-regulated goods.

Inspection and Clearance Process

After entry submission, CBP and FDA assess admissibility concurrently. CBP collects applicable duties, while FDA screens for compliance with safety and labeling standards.Inspections may involve physical examination, sampling, or laboratory testing of products. Section 321 shipments, despite being low-value, no longer benefit from exemptions and undergo the same review as other imports.Delays occur if products fail compliance checks, lack necessary documentation, or raise safety concerns. Clearance is granted only when both agencies confirm adherence to regulations, allowing goods to enter U.S. commerce.